Feeling the Heat — Oil Export Stalemate in Venezuela

Typically when a currency falls in value, investors flock to purchase that country’s assets and exports under the new exchange rate. The Venezuelan government however, is stuck producing nearly the same output. Why? Simply put, because of the South American country’s involvement in the Organization of the Petroleum Exporting Countries (OPEC) and its incredible reliance on oil, which is estimated by Reuters to be responsible for 96 percent of government revenue. Venezuela is in a position where it cannot produce more oil — to take advantage of break-even costs as low as $40 per barrel — or less, due to burgeoning global supply’s effect on prices.

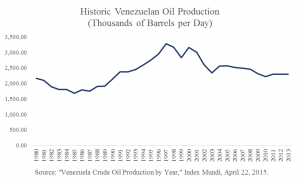

Venezuelan oil production has not risen substantially in almost two decades:

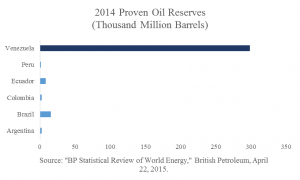

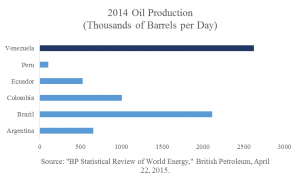

This is not the byproduct of a lack of private interest in the country: exploration and extraction companies such as Chevron already operate within Venezuela and the Bolivarian government even claims grievances against ExxonMobil for resource theft by its international waters with Guyana. This is not because the country is attempting to use its reserves more sustainably — Venezuela has the largest deposit of proven oil reserves, and owns over 17 percent of the world’s oil, compared to the rest of Latin America, which collectively owns less than 5 percent. The combined lack of productivity and revenue is due to OPEC quotas, which have become a thorn in President Maduro’s side. This has effectively stunted Venezuela’s production capacity compared to its neighbors:

Venezuela’s recent attempts to counter economic collapse and civil unrest have come in the form of two new deals:

- Much like Nicaragua and Venezuela’s accord to trade coffee beans for crude oil, and Cuba and Venezuela’s deal to trade oil for teachers and doctors, Uruguay has now agreed to begin trading food for oil

- India has joined China in becoming a key consumer of Venezuelan oil, with a long-term investment plan of $143.7 billion being put in place to develop infrastructure for oil production in Venezuela

Even if OPEC were to scale back production tomorrow, all of these attempts to harness and expand on the country’s competitive advantage are likely futile for Venezuela itself, as it has a fixed supply quota it cannot surpass. Additionally, because of that quota, strengthening oil trade with Asian countries has meant neglecting and making cutbacks with the rest of Central and South America. Supply shocks are already being felt in Petrocaribe, a trade bloc of Caribbean nations which rely heavily on Venezuelan crude.

Apart from simply diversifying their economy and liberalizing the market, it is becoming increasingly urgent that Venezuela corresponds with the needs of its people rather than the whims of OPEC. The ailing nation should reduce these regulatory barriers such that its production more accurately reflects growth in global oil demand, it is after all one of the few oil-rich nations that has yet to do so.

It seems that there are many other factors that play a key in this as well: Venezuela’s overvalued currency, the nationalization of oil producers resulting in inefficient production and lack of international reserves.