Upheaval — Natural Gas Growth Could Redefine Decades

Over the past few years, natural gas growth has been an energy investor’s fallback strategy. With a historically positive growth in almost every company’s stock and unperturbed fundamentals — promoted by technological advances — it is highly unlikely that such an industry trend is cyclical.

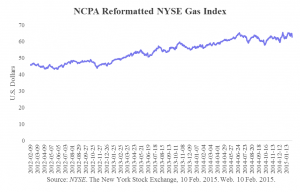

Some of gas’ most representative stocks (as deemed by the New York Stock Exchange) for companies such as Sempra Energy, Intergys Energy Group Inc. and AGL Resources Inc. were reformatted and indexed by the NCPA:

An unusually warm winter reduced energy demand and put a damper of gas prices, which suppressed growth towards the end of the graph in 2014. However, projections made by the Energy Information Administration (EIA) show that the sector will continue to expand at a stable rate throughout 2015 — supporting the theory that the market growth is due to a structural change.

In the case of the United States, this may be our golden age of natural gas. The U.S. is ready to be a net gas exporter by the end of this year, Market Realist proclaims “Some of the higher production in the Eagle Ford Shale in South Texas will be set to export to meet the growing demand from Mexico’s electric power sector.” On the other side of the Pacific, the same kinds of environmental laws that brought American coal to heel, such as the Clean Air Act (CAA), have come into effect as of January in China. The most prominent of which are the Chinese Air Pollution Prevention and Control Law’s amendments, which were made in response to deteriorating atmospheric quality over the country and the recent environmental initiatives taken between the United States and China. Thus, coal’s rising costs have instigated a shift in demand, one that will start favoring gas — this is a trend that could soon be seen globally.

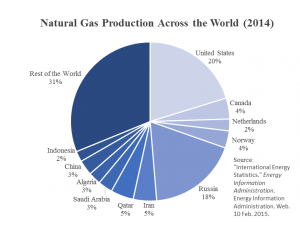

But where do we stand as gas producers, and why does that matter?

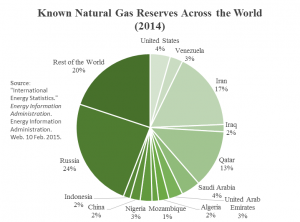

The United States is by no means the owner of the world’s largest natural gas reserves, however from the EIA’s datasets, one can intuitively see that for its reserves, the U.S. has an overwhelmingly dominant production capacity — meaning we have the most resources to extract and process gas. Should private and public players move to ease trade barriers between the countries, this is an advantage that the U.S. is unlikely to lose for years given China and other BRIC countries’ surging energy demands. Specifically, China’s policy changes have provided a niche for emerging American liquefied natural gas (LNG) vendors to seek partnership. We will not have a production advantage over other countries forever, and as the chart Known Natural Gas Reserves Across the World shows, a failure to capitalize on this opportunity would be a serious blow to American leadership and competitiveness on environmental, energy security and economic fronts.